Once you understand how you are currently spending, you can start making changes to widen the gap between your income and expenses.

#Budget planner calculator free free#

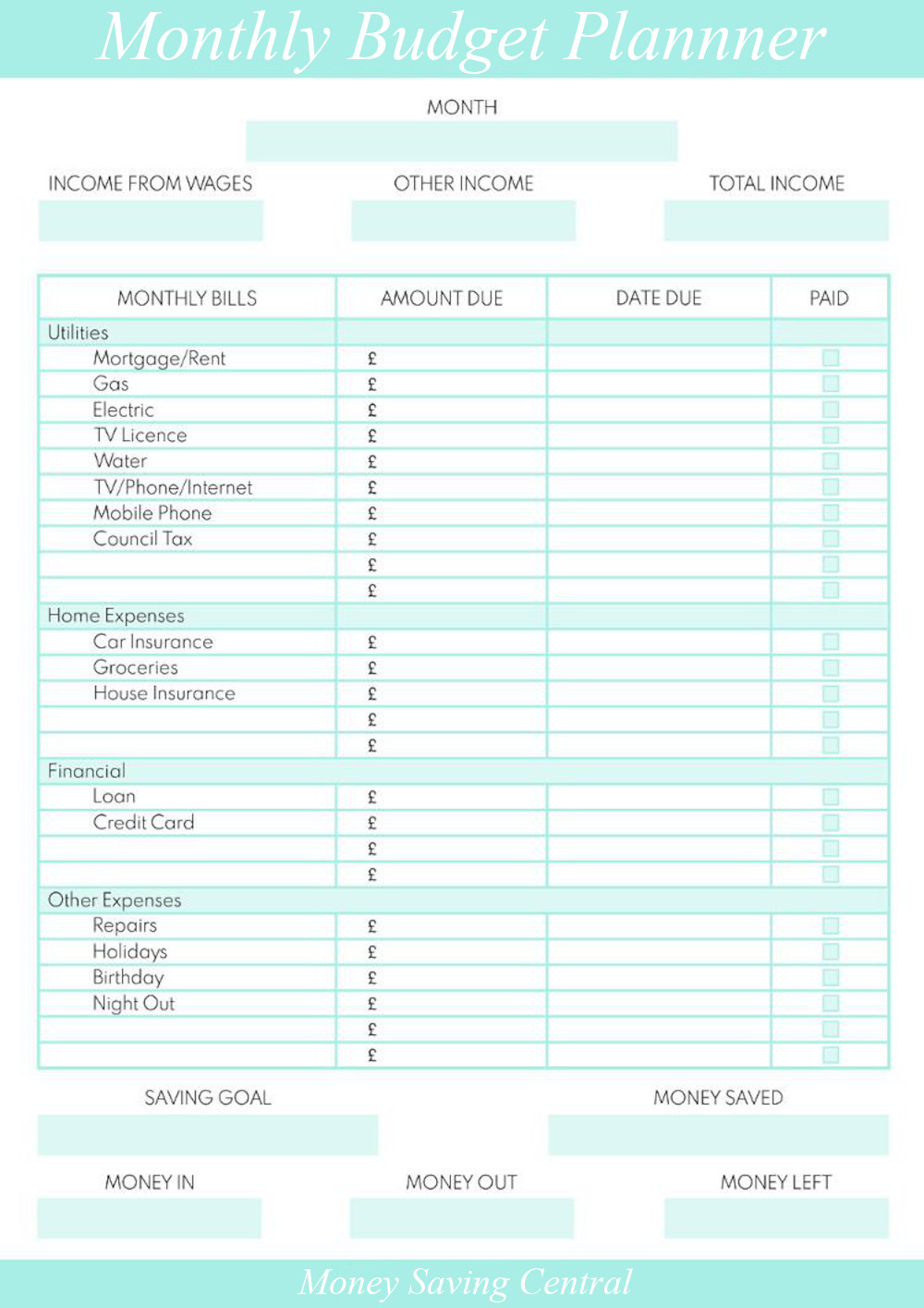

In most cases, when you don’t know where your money is going, it means that you are spending too much on purchases that might not be essential to your living, or does not bring you as much satisfaction as you thought.īudgeting, with the help of a tool like our free budget calculator, provides you with the opportunity to take control of your spending, and choose from the start of every month, where you want your money to go. Why You Should Budgetĭuring a budget planning exercise, you’ll soon start to realize that there are certain places and/or purchases that repeat frequently and therefore result in a higher monthly cost than you might think. The best way to truly take control of your money and plan a smart budget is to understand what your current spending patterns are. Take your time to analyze every transaction. For example, if you’ve spent a total of $1,200 on Recreation in the past six months, your monthly cost for recreation is $200 ($1,200 / 6 = $200). If you don’t know what you are currently spending on a monthly basis, the best way to find out is to take your last three to six months bank statements (including credit cards and store cards) and spend some time categorizing every outflow or payment into the categories as per our Budget Planner.Īdd the total per category and then divide this total by the number of months you used. Add your monthly costs (or yearly costs if asked) into each relevant category and let the budget calculator do its work. The Input section lists the different categories. Use your best judgment in your situation to what you deem essential or non-essential. This provides you with the perfect opportunity to consider how you can improve your spending, and work towards your long-term wealth.ĭepending on your lifestyle and situation, different categories can be classified as essential or non-essential. Using the budget planner, you can compare your spending on discretionary costs (which are costs non-essential to your livelihood) and then essential costs. Other categories (where most of your disposable income is likely going) include Entertainment, Vacation & Travel Expenses and more. The categories include your essentials such as Groceries, Home Rent, Fuel & Transit, Vehicle Lease and Personal care. The different categories provide an accurate indication of what your money is spent on most. The budget calculator is designed to give you a clear visual representation of your monthly equivalent expenses. Have you ever found yourself at the end of the month, looking at your bank balance, and asking yourself: Where has all my money gone? Use our free budget planner to clearly see where your hard-earned money has been spent. One of the most important aspects of managing your money is knowing where your money is going. LOANS ARE ARRANGED THROUGH 3RD PARTY LENDERS.The Budget Planner Calculator is a free tool for anyone who wants to take their personal finance to the next level. NO MORTGAGE SOLICITATION ACTIVITY OR LOAN APPLICATIONS FOR PROPERTIES LOCATED IN THE STATE OF NEW YORK CAN BE FACILITATED THROUGH THIS SITE. THIS SITE IS NOT AUTHORIZED BY THE NEW YORK STATE DEPARTMENT OF FINANCIAL SERVICES. INFORMATION RECEIVED WILL BE SHARED WITH ONE OR MORE THIRD PARTIES IN CONNECTION WITH YOUR RESIDENTIAL MORTGAGE

#Budget planner calculator free generator#

CFL License #60DBO-116115 | License and disclosure | NMLS Consumer Access LEAD GENERATOR ONLY, NOT ACTING IN THE CAPACITY OF A MORTGAGE LOAN ORIGINATOR, MORTGAGE BROKER, MORTGAGE CORRESPONDENT LENDER OR MORTGAGE LENDER. In California loans are made or arranged by Intuit Mortgage Inc.

(CFL #6055856) | Licenses The Mint Mortgage experience is a service offered by Intuit Mortgage Inc., a subsidiary of Intuit Inc, NMLS #1979518. In California, loans are made or arranged by Intuit Financing Inc. ( NMLS #1136148), a subsidiary of Intuit Inc. Intuit Personal Loan Platform is a service offered by Intuit Financing Inc.

0 kommentar(er)

0 kommentar(er)